The One Big Beautiful Bill Act, OBBBA for short passed the Senate and the House in time for Trump’s 4th of July deadline. We’re going to do a quick tour through the bill and put together a basket of OBBBA names, from drones to detention facilities to spaceports.

Without getting political why does this bill matter?

Presidents typically get only one signature bill during their term. Why is that?

Bills take at least six months to put together- the legislative process isn’t known for being quick

Historically presidents are most popular during the first year of their term, their political capital decreases after that

The president’s party on average loses 28 house seats and 4 senate seats during their term. Republicans only have an 8 seat advantage in the house. It’s hard to keep a trifecta after midterms

Markets are bad at pricing signature legislation

Did you understand the implications of Medicare Advantage in the affordable care act? Congrats! You outperformed the market for a decade

Or what about buying the largest construction equipment company after the largest infrastructure bill in 50 years was passed. That worked?

Why is the market bad at pricing this stuff in? Most market participants don’t have the time to read a 800 page bill. Most also don’t grasp how big a trillion dollars is (that’s 1,000 billion if you’re not sure).

These things also generally take a couple years to kick in, so it doesn’t go immediately to the bottom line.

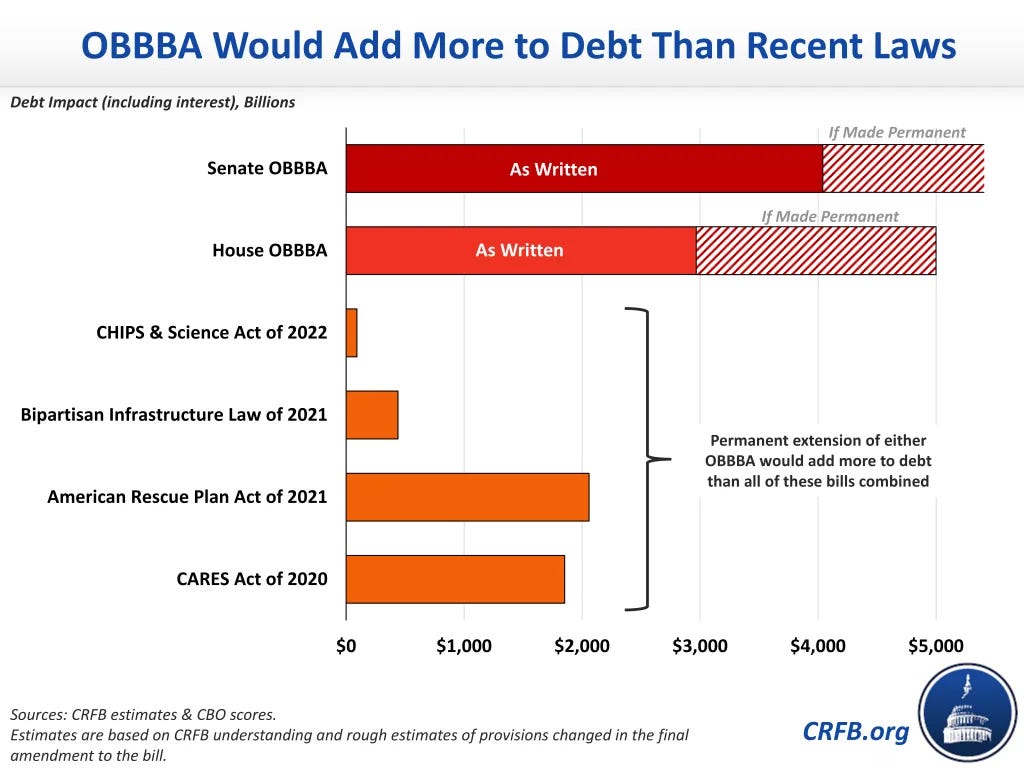

This is a lot of money being spent

The OBBBA will add more to the debt than the all of Biden’s legislation combined

However, the White House argues if you consider the TJCA policies as baseline, the OBBBA will actually reduce the deficit by $395B over the next 10 years

Even if you accept this logic, the OBBBA will be a stimulus of at least $100B every year within Trump’s term, with the bulk of the cuts kicking in 2030 or later.

(N.B. Most cuts are medicaid-related, the most significant provision being a clause requiring in a month 80 hrs of work, 80 hours of community service, or a half-time education program to qualify for Medicaid)

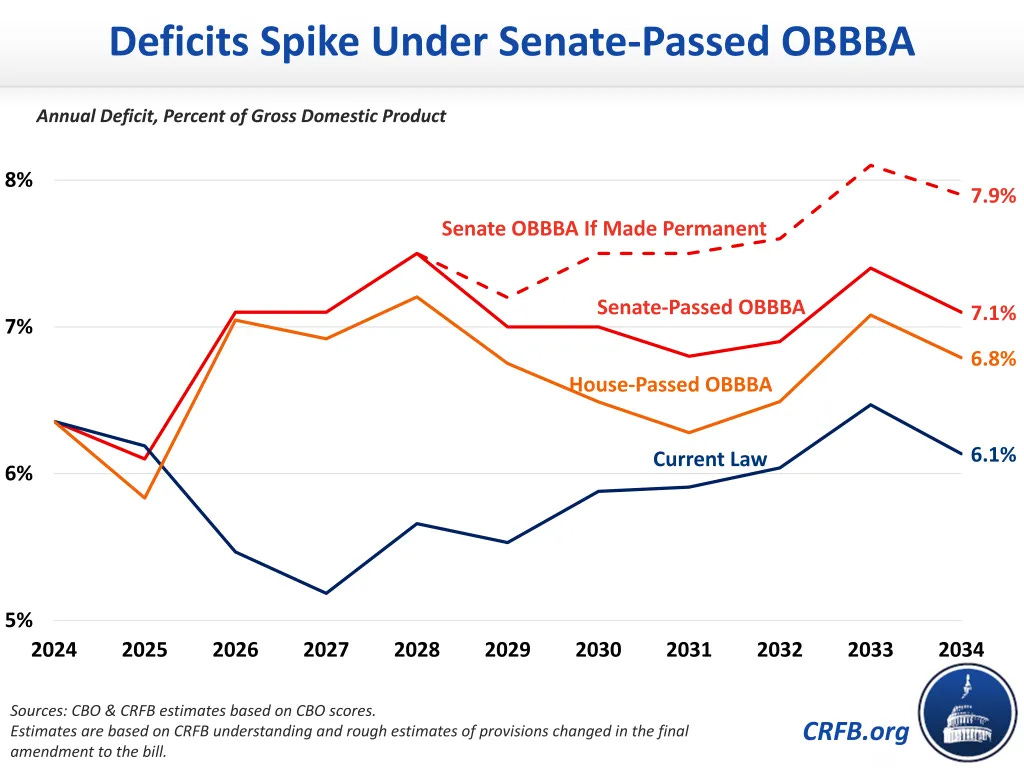

This also means the current budget deficit is expected to go from 6% to 7.5%

First takeaway: You cannot be short the market heading into a 7.5% non-recessionary peacetime deficit

Job numbers, tariffs, whatever, you are fighting gravity if you are going against the market in the next couple years

Some of these tax breaks directly increase disposable income (standard deduction increase, deductions for seniors, no tax on tips, no tax on overtimes)

You can short bonds if you are feeling a bearish impulse, but do not short equities.

In general, this bill makes a higher for longer scenario more likely as you have the deficit contributions. The border spending should also lower the supply side of employment, decreasing the unemployment rate.

_______________________________________________

Now diving into the unique implications

Time to long defense stocks ($HII, $AVAV)

The big beautiful bill contains a boost to defense spending (beyond what was already in the budget)

Shipbuilding gets the largest boost with items including:

$2,100,000,000 for development, procure-

ment, and integration of purpose-built medium un-

manned surface vessels;

$492,000,000 for next-generation ship-

building techniques;

$1,470,000,000 for the implementation of a

multi-ship amphibious warship contract;

$1,300,000,000 for expansion of unmanned

underwater vehicle production

There’s really only one shipbuilder of relevance, that’s $HII. HII is up 30% YTD but is flat since 2018 and its 18 PE is within its normal trading range for the past decade, so it goes in the bucket.

We also get a decent amount of “new tech defense funding.” This includes

$1,000,000,000 for the expansion of the one- way attack unmanned aerial systems industrial base

$250,000,000 for development and testing of directed energy capabilities by the Under Secretary for Research and Engineering

$350,000,000 for development, production, and integration of non-kinetic counter-unmanned aerial systems programs;

We’ll include $AVAV, a drone stock that recently bought BlueHalo, a directed energy military contractor. It’s trading at a hefty 100+ PE, but is in all the right lanes.

No tax on tips ($PZZA)

The OBBBA introduces a deduction on tips- under this section for any taxable year up to $25,000. Specifically this is deduction is for:

A) The providing, delivering, or serving of food or beverages for consumption, if the tipping of employees delivering or serving food or beverages by customers is customary.

B) The providing of any of the following services to a customer or client if the tipping of employees providing such services is customary: (i) Barbering and hair care, (ii) Nail care, (iii) Esthetics, (IV) Body and spa treatments.

The long for this one would be $DASH. The gig economy is something someone can do part-time and now not be taxed on. DASH is already up 40% YTD. and trading at 300+ PE. So we’re going to go more artisanal with Papa Johns $PZZA at a 5 PE. Pizza delivery is already reliant on tips and now that can be tax free. There was also an acquisition offer from Apollo at $60 a month ago, so this could get bought out and you make 20% or you can wait for Todd Penegor (Wendy’s CEO from 2016 to 2024) to turn it around.

Welcome to the Trump Account ($HOOD)

The law creates a new type of investment account, the TRUMP ACCOUNT

It functions like an IRA where for kids: “no distribution will be allowed before the first day of the calendar year in which the account beneficiary attains age 18.”

The account can only invest in non-leveraged mutual funds or ETFs that charge no more than 0.1% fees and is composed of the S&P 500 index or any other index that is primarily US companies and is traded on futures (so tied to S&P, Dow or Nasdaq).

Any child born between Dec 31, 2024 and Jan 1, 2029 will be eligible to receive a $1,000 contribution from the Federal Government in a Trump account.

If you check who was pushing this policy, the Invest America roundtable with Trump included “Micheal Dell, Brad Gerstner of Altimeter Capital, Rene Haas of Arm Holdings, Parker Harris of Slack and Salesforce, William McDermott of ServiceNow, Dara Khosrowshahi of Uber, David Solomon of Goldman Sachs, Vladimir Tenev of Robinhood”

Unfortunately that means you have to long HOOD on this one as Tenev had the insider track and likely has a product already in development to be your Trump account brokerage. Every kid gets a Robinhood account with $1,000! Yay!

Taking a hammer to gambling ($IGT):

The bill includes the following language, in a last-minute addition:

"For purposes of losses from wagering transactions, the amount allowed as a deduction for any taxable year— shall be equal to 90 percent of the amount of such losses during such taxable year”

Imagine I go to the Casino twice this year and the first session, I win $5,000 in Poker and the second session I lose $5,000. I would normally owe no tax, but under this bill I would owe a tax on $500 ($4,500-$5,000)

The initial gut instinct would be to short $DKNG, but most DKNG customers are not doing large enough bets, to where they wouldn’t be covered by the standard deduction. This is the same audience that is doing 5-leg parlays on the regular. They aren’t the best at math.

The next idea would be going after the mega casinos (MGM, WYNN), but they have solid international exposure.

One potential long is $IGT. IGT recently sold its gambling operations to Apollo, making it a pure-play lottery operator (~60% US, 40% Italy). The new company is to pay a $3 special dividend on July 14th and has authorized $500M buyback. The lottery business is a better one than one would think and any headwinds to state gambling revenue may encourage a larger focus on lotteries.

Spaceports are airports ($RKLB)

Here’s a fun one: “SPACEPORTS ARE TREATED LIKE AIRPORTS. UNDER EXEMPT FACILITY BOND RULES.

(C) SPECIAL RULE FOR SPACEPORT GROUND LEASES.—Spaceport property located on land leased by a governmental unit from the United States shall not fail to be treated as owned by a governmental unit

(3) PUBLIC USE REQUIREMENT.—A facility shall not be required to be available for use by the general public to be treated as a spaceport for purposes of this section.”

This means Spaceports will be able to issue municipal bonds even while not being available for the general public. That’s cheap tax-free financing.

That’s good news for RKLB who operates a US Space Port (Launch Complex 2) and is currently constructing Launch Complex 3.

Orphan Drugs Get a Win ($ROIV)

Vivek who spent 10 days in DOGE was able to get this nice rule change in

Section 1192(e) of the Social Security Act by striking ''only one rare disease or condition'' and inserting ''one or more rare diseases or conditions''; and (B) by striking ''such disease or condition'' and inserting ''one or more such rare diseases or conditions''.

There is also a clause that moves the date of Medicare price negotiation eligibility from the original approval date to "the first day after the date of such licensure for which such biological product is not a biological product described in (A)".

This means for Orphan Drug companies, they can use the same drugs for multiple rare conditions without losing the Orphan drug status and they also get to keep their. Medicare pricing protection until they completely lose orphan designation - which could be indefinitely if they maintain rare disease indications.

This makes ROIV’s portfolio of orphan drugs much more valuable.

A Ton of Border Spending ($GEO, $CXW)

The OBBBA significantly boosts border spending including

$47,550,000,000 for the border infrastructure/wall

~$6B for Border Personnel

$10B/year for generally safeguarding the borders of the United States

The most impactful clause is “$45,000,000,000, for single adult alien detention capacity and family residential center capacity.”

That’s $45 BILLION, specifically for constructing new border detention facilities.

Private prison stocks GEO and CXW have been Trump trading sardines for a decade now, so it’s easy to forget they are real businesses. While GEO and CXW are up 75% and 60% since the election respectively, I don’t think the bulls in their wildest dreams had a $45B budget for detention facilities (to be spent by September 30, 2029).

The MCs of GEO and CXW are $3.5B and $2.3B respectively. So while it would be easy to say “priced in, I don’t think that’s remotely the case.

There’s more things in the bill, but those were just a few of the themes that stuck out

Here’s how I would position a “OBBBA” portfolio:

Currently I own one of these names $AVAV, but will be looking for key spots to add the others.

Not investment advice - just ideas that seemed brilliant at 2am. Do your own research.