CM #1: Sports Betting, Kalshi, and what's ahead for DraftKings?

New CFTC leadership could create headwinds

DraftKings ($DKNG) is up 47% YTD as investors continue to be impressed by the Sportsbook’s momentum. While DraftKings hasn’t made a profit as a public company, their Sportsbook continues to show impressive growth YoY.

In the last quarter, DraftKings handle (total $ bets on the platform) was $14.90B, up from $12.94B the year prior. This translated to $825M in Sportbook revenue with DraftKings “cut” being 5.5%

While DraftKings is not profitable, the most obvious reason is the sales/marketing expense, making 2/3rds of the cost of revenue.

While this would usually be too much marketing spend for a company, DraftKings and FanDuel have done a strategy of “blitzing” a new market with promotions and ads whenever a sports betting first becomes legal. Investors anticipate DraftKings to take down marketing spend as it once it obtains sufficient market share in most states.

Sports Betting Background

The Supreme Court struck down the Professional and Amateur Sports Protection Act in 2018, paving the way for Sportsbooks to become legal in the US states outside Nevada. States quickly began to legalize it- one reason was to offset declining revenues from gas taxes (higher fuel efficiency/EVs)

Advancements in technology meant bets could now be done on your phone, making it more accessible than ever.

Benefits from Imperfect Competition

While there were plenty of companies that wanted to get into the market, most states legalizing sports betting wanted this to be done by trusted casinos and vendors, not your local bookie. In practice, this meant most states limited their market to a # of Sportbooks, such as 20 in Ohio or 9 in New York.

For example: BetFred, a well-established British sports book doesn’t operate in many of the states DraftKings operates in. This also means that once a market is established and the vendors are selected, DraftKings and FanDuel only need to win against the initial competition, and not worry about new entrants, making the spend on marketing dollars attractive.

The business has started taken on Duopoly characteristics, with FanDuel/Draftkings taking share from the other competitors, who had often had worse digital experiences, were less aggressive with advertising, or were afraid of cannibalizing their casino business. Most investors imagine this emerging duopoly structure turning into significant profits. DraftKings currently has a $26B MC.

Enter the Prediction Markets

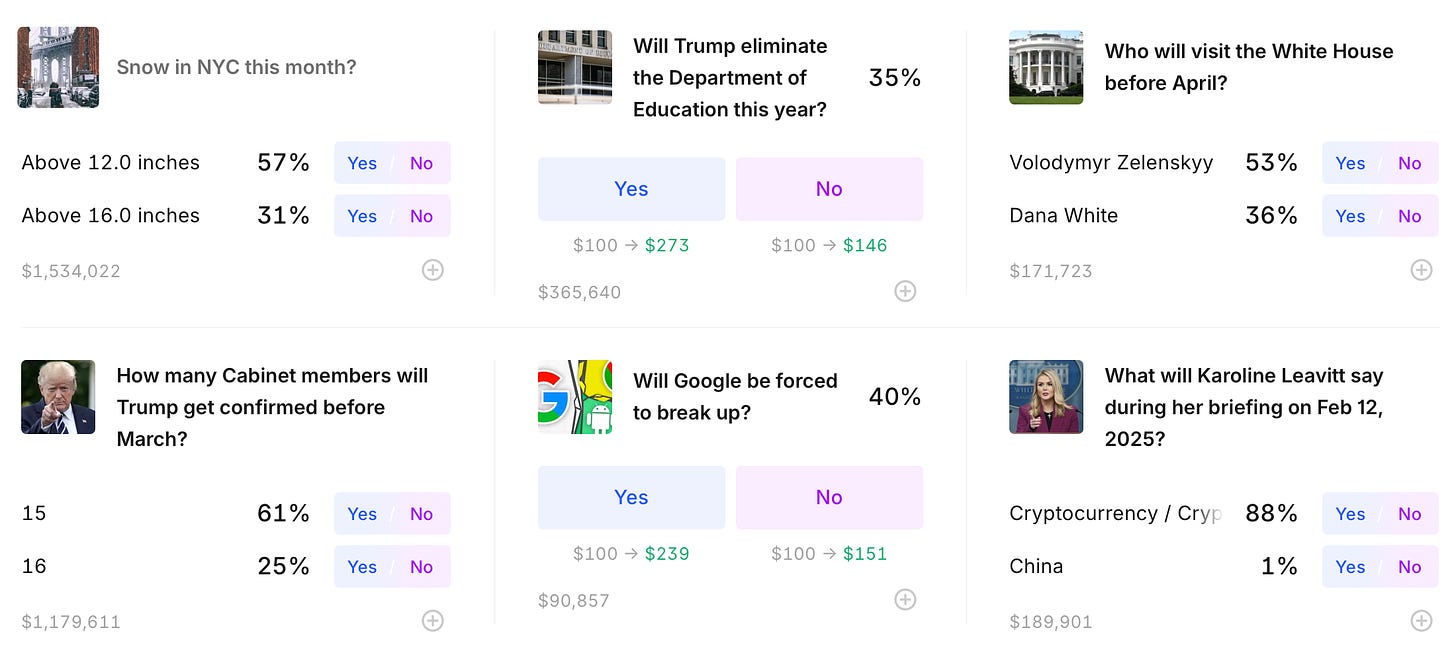

Prediction Markets are sites where users can wager on the outcomes of future events, such as who will visit the White House first: Dana White or Zelensky? These started to become popular in the last decade.

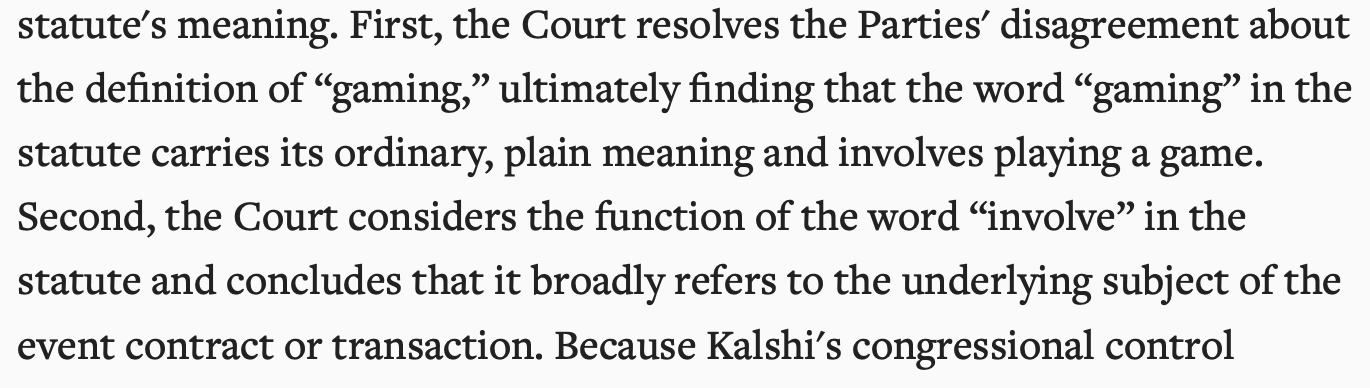

It was not clear from the text of the law if these sites constituted gambling (illegal in many states) or were more akin to a futures market (will Oil trade above $90 in August). The CFTC was given the power under Dodd-Frank, “the ability to view, and prohibit, event contracts that it determines are contrary to the public interest if, and only if, they involve specific activities, including ‘activity that is unlawful under any Federal or State law’ and “gaming.” The venture-backed Kalshi was able to obtain a conditional waiver from the CFTC to offer prediction markets in 2020. The CFTC preferred having oversight vs. the bets happening on its unlicensed crypto-based competition such as Polymarket.

The 2024 election boosted the popularity of prediction markets, as users bet on the outcome both of the election and the events leading up to it (who will be Trump’s VP?) (will Biden drop out?) This raised a relevant question for the CFTC: shouldn’t predicting election outcomes fall under “gaming” and be prohibited? The CFTC sent an order to Kalshi block election bets, arguing that gaming and gambling were synonymous and election predictions were a form of gambling:

Kalshi argued gaming required in its defintion playing a game - blackjack, poker, roulette. The court agreed:

This decision effectively stripped the CFTC of its ability to regulate prediction markets. Prediction markets still have to specify concrete outcomes under the current CFTC rules. For example, on this prediction market for the “best AI” the outcome has to be unambiguous (ranking on Chatbot Arena on Feb. 28th)

Sports are future events with unambiguous outcomes, so Kalshi and other platforms decided predicting sports was legal, akin to a futures contract. Various platforms such as Crypto.com and Robinhood began to offer bets on the Super Bowl:

The CFTC asked Robinhood to hit the brakes, noting concerns about sports “predictions” being offered alongside equity investments, but recent developments have made it much more likely that CFTC will embrace sports contracts, placing the margin profile of DraftKings in potential jeopardy.

The White House Embraces Kalshi/Prediction Markets

In one of the more likely displays of corruption in the first month of Trump’s presidency: Donald Trump Jr. joined Kalshi as a strategic advisor.

Following this move, Trump named as the head of the CFTC, Brian Quintenz, who while a former CFTC commissioner, was also recently on the board of Kalshi.

If Quintenz’ connections weren’t clear enough on his views, in 2021, he published a CFTC dissent relating to a company called ErisX which was offering NFL Moneyline futures. In his dissent, titled “Any Given Sunday in the Futures Market,” Quintenz’ was very clear that he believes sports betting is a typical commodity futures market:

Quintenz argued in the dissent that sports betting can be distinguished from gaming- pure games of chance such as Blackjack, because they are predictable to a point:

There are “sharps” in Vegas who have made a career out of a sports betting, just the public on average is very bad at it. The other question is whether allowing these contracts is in the public interest, Quintenz’ believed that “public interest” is too vague a term to make decisions on, but there is an argument that sports futures can be within the public interest, due to making sports betting cheaper.

This isn’t too hard of an argument to make.

When you play a bet, most sports book will take hold revenue. When a spread is set by a sports book, that is typically meant to be 50/50 odds. So for this all star game: there is assumed to be a 50/50 chance Team Chuck wins by 3.5 points

Now notice most books have -110 under the spread. This means you have to bet $110 to win $100. So even though Team Chuck has a 50% chance of winning by 3.5+, your actual odds on a bet on are closer to 45% as Draft Kings keeps an extra $10 if you win. Currently DraftKings’ average hold is 9.4%, but management believes it can get to 11% over time:

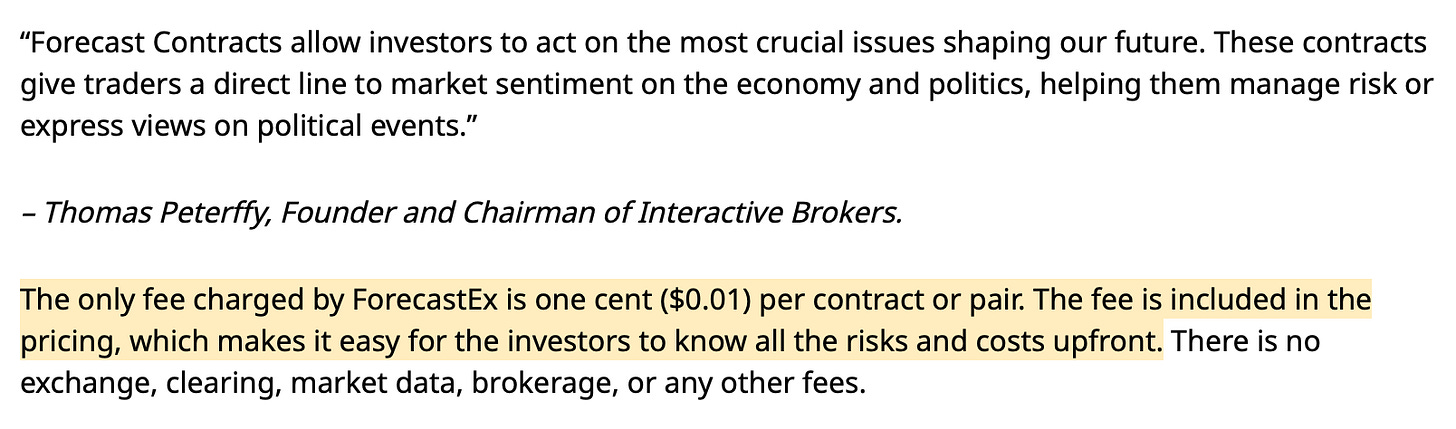

Prediction markets have the ability to run with much lower holds. Interactive Brokers’ ForecastEx is only charging 1 cent per contract.

With contracts being 100 cents total (100% of being right), this means the same 50% odds bet at before could have a hold of only 2% (1 cent). Kalshi is currently operating at a 7% hold (across the board), but I expect this to decrease given the competition.

Implications for DraftKings

So effectively, we’re in a period where sports “predictions” is a gray area under the law, with an incoming CFTC chair and the president’s son having a vested interest in prediction markets. It is also possible, given Quintenz’ ties to A16z Crypto, he may even try to open the market to crypto-based platforms such as Polymarket.

If the CFTC confirms a regulatory stance that sports prediction markets are legal nationwide this will create a number of headwinds for DraftKings. California/Texas would be open for business faster than expected, but it is already clear from the Super Bowl that new competitors will include retail brokerages such as Robinhood and crypto exchanges like Crypto.com. WeBull and other platforms may also enter this space. Instead of decreasing its marketing spend as anticipated in 2026/2027 DraftKings likely would have to increase it up to defend against these competitors.

Unlike previous competition (such as the ESPN Bet), these competitors should be structurally cheaper for sports betters. Beyond lower holds (the bar to be consistently profitable is winning 52% of the time instead of 55%), DraftKings has a practice of limiting or banning players who win consistently. Prediction markets work on a zero-sum brokerage model- if one player wins, another player loses. Winners in prediction markets can keep winning, and Kalshi or ForecastEx will take their cut. These markets are also likely exempt from current state taxes on gaming.

There are some differences- more niche markets such as college lacrosse will have trouble finding enough liquidity for bets. For those markets, DraftKings itself is taking the other side of the bet, effectively playing the role of a market maker. Still the big 4 sports and notable events such as March Madness should have liquidity enough for most bettors, given Robinhood has 24 million users. Illinois reports monthly data on wagers by sports. Football and Basketball in December were far more popular for betting than any other sport:

DraftKings in the face of the new competition may face pressure to reduce its hold percentage instead of working its way up to 11% as management anticipated.

On the last earnings call, DraftKings was asked by Merrill Lynch’s Shaun Kelly about prediction markets: “What's DraftKings' initial take here? Is this something you'd get into? Or what can kind of protect or differentiate you from that kind of offering?”

Management responded: "Yeah. I do think you're right. It's early. We are watching it very actively. It's certainly something that we have keen interest in seeing how it plays out. So I think there's some, in the next couple of months, 60 days or so, there's going to be a CFTC ruling and all sorts of other things, so I think we'll know a lot more over the next few months.”

It is possible the other FTC commissioners force Quintenz to adopt a compromise view, but given Donald Trump Jr.’s involvement, there could be substantial political pressure from the White House to get this done.

Conclusion

As the regulatory view comes into play over the next 60 days, it is quite likely DraftKings’ stock could suffer as DraftKings does not have room for error in its valuation. DraftKings is currently trading at 93 NTM PE, although analysts expect that to improve to 35 PE in 2026 as DraftKings pulls back on marketing spend while continuing to grow.

If DraftKings faces pressure on hold margins or is forced to increase marketing spend in 2026 to combat the new prediction market players, the turn to profitability could be delayed. Management’s initial non-answer suggests they do not believe this is bullish for DraftKings. This is likely a case where the market hasn’t caught up to a story that could develop quicker than expected.